We can skip past marketing and start at a point where you already have a group you’re talking to. There are 5 very important things to think of when trying to secure a group.

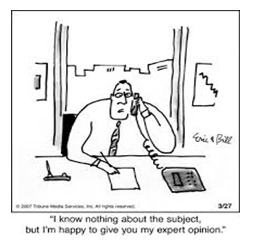

John said:

“Couldn’t have been easier. I wasn’t in a position to look after the group, so I was happy I

could call on an expert to take it off my hands. And I got paid”.

“While every care has been taken to supply accurate information, errors and omissions may occur. Accordingly Group Health and Life accepts no

responsibility for any loss caused as a result of any person relying on the information supplied.”

A disclosure statement under the Securities Markets Act 1988 relating to the financial adviser associated with this document is available on request

and free of charge.