Are you putting off taking out insurance because trying to cover all the risks in your life is too expensive?

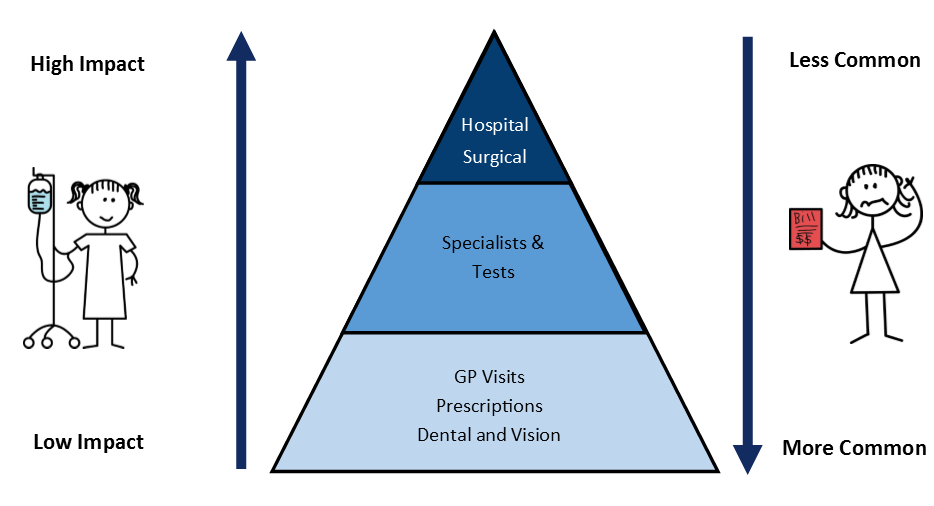

The different forms of personal insurance available – health, life, trauma, total permanent disablement, income protection, etc. – can be overwhelming. We’ve had people come to us with quotes from banks that have far exceeded what their budget allows for insurance. Unfortunately, right when we need personal insurance the most, e.g. when taking on large debt such as a mortgage, or starting a family, is also when we have a lot of other bills to pay. If you (like most people) have a limited insurance budget, we recommend you cover the high impact, less common events first; see diagram below.

Health Insurance Example

Using health insurance as an example, there are some comprehensive products available that cover GP visits, prescriptions, and include annual allowances for dentistry and optometrists/glasses. However, these are high-end products with premiums to match. First and foremost, your health insurance should cover the cost of major health events – e.g. hospitalisation and surgery. While less common, these events are likely to have a big impact on your life. Most people can’t afford to pay these costs themselves, meaning those without health insurance end up sitting on lengthy public waiting lists.

If you can afford to include cover for specialist consults and diagnostic testing that’s great, but if you can’t at this stage it’s always good to find out how easy it would be to upgrade your cover later on – i.e. would you need to be medically assessed and underwritten again? This approach means that you will need to cover the costs of everyday healthcare yourself, such as GP visits and prescriptions. However, these costs are a lot more manageable and can usually be budgeted for.

In short, don’t let the high premiums of complex insurance products put you off taking out basic cover to protect you and your family against the big stuff.